Early on, Sameer Aggarwal the EV financing revolutinary, had a relationship with “prime.” His first job after graduating from IIT Kharagpur, one of the top engineering schools, was with HSBC. A few years later, the Delhi native moved to London. He kept working for one of the biggest financial and banking institutions in the world. During his nearly ten-year tenure, he held important positions like managing a portfolio worth £20 billion. This included credit cards, and operating in 15 locations across six continents

Then Sameer Aggarwal RevFin journey started and his performance was exceptional. Supporters of RevFin are thrilled with the outcome. Following several months of brainstorming, Aggarwal ran into an EV manufacturer. He remembers, “It was serendipity.” It was October, the air in Delhi was already oppressive due to heavy vehicle emissions. Delhi was progressively becoming choked due to the yearly ritual of stubble burning by farmers throughout Delhi-NCR, Haryana, and Punjab. Aggarwal was seated in his one-room office in Central Delhi when the visitor nudged him, asking, “Why don’t you start financing electric three-wheelers? They cost about Rs. 1.5 lakh, and there is tremendous possibility for expansion, he emphasised.

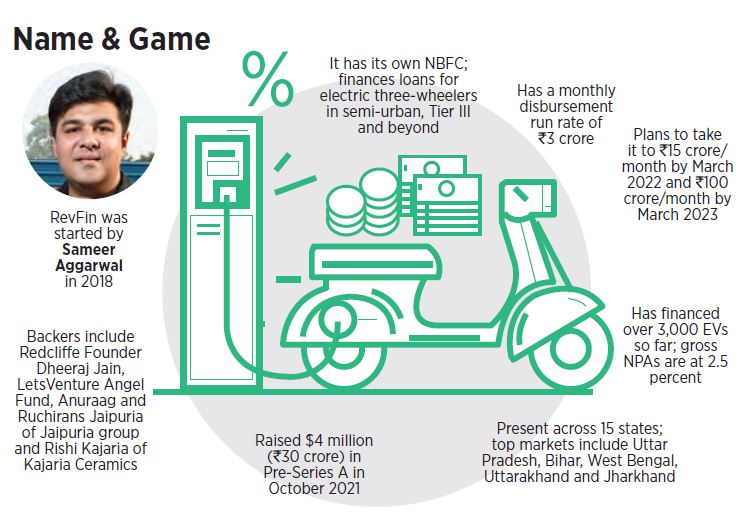

The concept had a powerful presence. Aggarwal explained, “It was beneficial for the ecology.” But was it profitable? To answer the call, the former banker only required one set of information. There were about 20 lakh then. After a year and a half since the nationwide shutdown, commerce is booming. The monthly distribution run-rate for RevFin is currently $3. The company plans to increase it to $15 per month by March of 2019. According to Aggarwal, the firm has so far financed more than 3,000 EVs. This plans to disburse $100 crore each month by the end of March 2023.

Sameer Aggarwal Progress with RevFin

Over the next several years, India is likely to experience an increase in the use of electric rickshaws for another reason. There is still no idea of last-mile passenger mobility, according to Sameer Aggarwal, in many small communities. We believe that electric rickshaws are the solution and that this presents a big potential.

Can the startup face difficulties from aggressive lending to a market niche that has no credit exposure? According to Aggarwal, two elements have made sure that RevFin’s wagers are covered. All loans are secured loans, to start with. The cars are attributed to the beginning. The element of pride and shame comes in second. Owning a car is something to be proud of for people who work a regular job, he claims.

The native of Delhi, Sameer Aggarwal, relocated to London at an early age and continued to work for one of the largest financial and banking firms in the world. He held significant responsibilities during his career of almost ten years, including running operations in 15 sites on six continents and managing a portfolio worth £20 billion that included credit cards.

After months of planning, Aggarwal came across an EV manufacturer. It was serendipity, as he recalls. Why don’t you start financing electric three-wheelers? the visitor nudged Aggarwal as he was seated in his small office in the heart of Delhi. He emphasized that they cost around Rs. 1.5 lakh and that there is a ton of room for growth. The founder of RevFin, Sameer Aggarwal, then appeared.

What Next?

Over the next several years, India is likely to experience an increase in the use of electric rickshaws for another reason. There is still no idea of last-mile passenger mobility, according to Aggarwal, in many small communities. We believe that electric rickshaws are the solution and that this presents a big potential.

Given that it provides a respectable source of revenue, they do not wish to get rid of it. The shame factor for defaulters is when loan collectors come to your door to recover their debt.

Additional revenue engines will be added by RevFin as well. By working with OEMs (original equipment manufacturers), dealers, and point-of-sale finance, it will deepen its network throughout 16 states while also expanding its core business of financing electric three-wheelers.

Revenue Model

Sameer Aggarwal notes that RevFin has begun collaborating with fleet operators that oversee operations for ecommerce firms as the Swiggys and Amazons of the world work toward electrifying their fleet. According to him, this business model will also encompass electric two-wheelers and e-autos and will be more focused on large cities than on small villages. “By October next year, nearly half of our business will come from this vertical,” he predicts, adding that ecommerce might eventually overtake traditional sales as the company’s primary source of income. He asserts that RevFin is already clocking an annualized revenue run rate of 7 crore and is aiming for a three-fold increase during the upcoming fiscal year. Our next goal is 25 crore, and after that, 75 crore, he continues.

Supporters of RevFin are thrilled with the outcome. According to Dheeraj Jain, founder of Redcliffe Life Diagnostics, “they have quickly created a financing network in over 100 small communities with nearly $0 customer acquisition cost”. He asserts that compared to vehicles powered by ICE (internal combustion engines). That use gasoline and diesel, commercial EVs offer drivers a significantly lower total cost of ownership. The majority of e-commerce enterprises have also committed to switching their fleet to electric, according to Jain. He also argues that the country should adopt EVs at a high rate because of its superior economics and environmental friendliness. What Aggarwal should remember, is that displaying too much aggression in lending business—whether prime or subprime—carries with it an inherent warning: Shock and awe. Everyone should take inspiratio fro m sameer’s story and never think low of themselves.

POV of Supporters

Supporters of RevFin are thrilled with the outcome. According to Dheeraj Jain, founder of Redcliffe Life Diagnostics, “they have quickly created a financing network in over 100 small communities with nearly $0 customer acquisition cost.” He asserts that compared to vehicles powered by ICE (internal combustion engines) that use gasoline and diesel, commercial EVs offer drivers a significantly lower total cost of ownership.

By March 2023, the business hopes to increase its geographic reach to 25 states and gain over 10% of the market for financing electric three-wheelers by using the cash raised. In the next five years, RevFin wants to finance two million electric automobiles. Over 10,000 electric three-wheelers have already been financed by the company across 14 states. Over the past four years, the company has improved its products and services in order to achieve its objectives. Beginning with loans for e3Ws, it has since included more modern financial solutions like leasing and lending for L3. This as well as for all vehicles used for last-mile and mid-mile connection, as well as for ecommerce logistics.

Former HSBC banker Sameer Aggarwal has been a prime mover in financing electric rickshaws with RevFin. Will the gambit pay off?

The majority of e-commerce enterprises have also committed to switching their fleet to electric, according to Jain, who also argues that the country should adopt EVs at a high rate because of its superior economics and environmental friendliness.

The business has also lately begun funding two-wheelers used for last-mile deliveries and e-commerce, such as food deliveries. Additionally, it has ambitions to finance four-wheelers, including trucks used for goods delivery and ride-sharing taxis. With 400 dealerships, RevFin is currently fully functioning in 14 states. The OEM alliance and reach are both being gradually expanded, and it has already paid out more than $16 million.

Sameer Aggarwal had a relationship with “prime” at the beginning. His first employment out of one of the premier engineering institutions, IIT Kharagpur, was with HSBC. The Delhi native relocated to London a few years later. There he continued to work for one of the largest financial and banking firms in the world. He held significant responsibilities during his career of almost ten years, including running operations in 15 sites on six continents and managing a portfolio worth £20 billion that included credit cards. He then began playing RevFin, and he displayed remarkable performance. The result has excited RevFin’s supporters.

After months of planning, Aggarwal came across an EV manufacturer. It was serendipity, he recalls. It being October, Delhi’s air was already suffocating from heavy car emissions, and farmers in Punjab, Haryana, and Delhi-NCR were beginning their annual tradition of burning stubble. Why don’t you start financing electric three-wheelers? the visitor nudged Aggarwal as he was seated in his small office in the heart of Delhi. He emphasized that they cost around Rs. 1.5 lakh and that there is a ton of room for growth.

Why EV financing?

The idea had a strong presence. According to Aggarwal, “It was good for the ecological.” But did it turn a profit? The former banker simply needed one set of details to answer the phone. The nationwide shutdown was almost a year and a half ago, and since then, business is growing. Currently, RevFin’s monthly distribution run-rate is $3, but by March 2019, the business intends to raise it to $15. Aggarwal claims that the company has already funded more than 3,000 electric vehicles and intends to spend $100 crore per month by the end of March 2023.

Additionally, it states that its gross NPA (non-performing assets) percentage is 2.5 percent. Before the pandemic, there wasn’t even one instance of default, he claims. Some of the borrowers, who were largely employees on a daily income, missed their EMIs since they were unemployed during the lockout, while others were able to manage their money well.